income tax rate malaysia

Taxable income band MYR. ITA enforces administration and collection.

Tax Guide For Expats In Malaysia Expatgo

Up to RM3000 for.

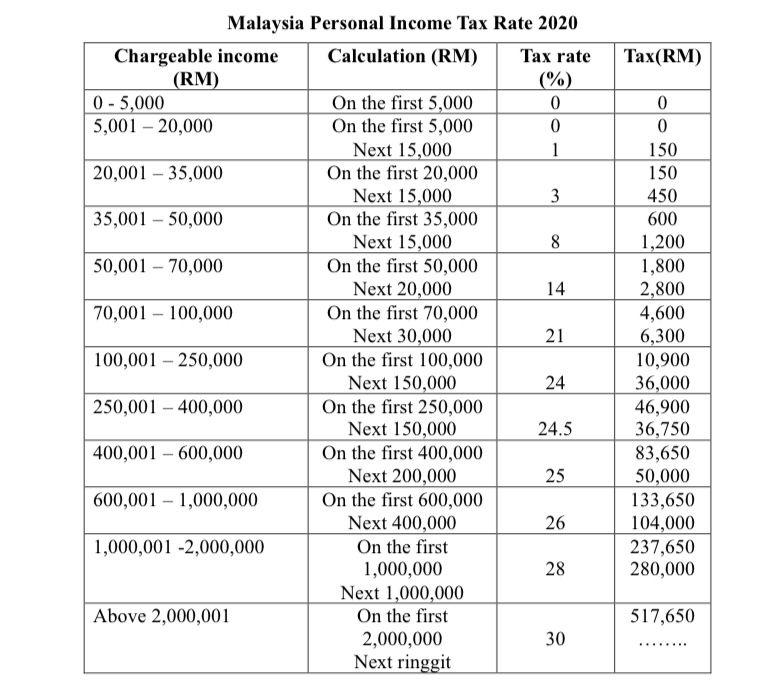

. The Malaysian corporate standard income tax rate is 24 applicable to resident or non-resident companies that earn revenue inside Malaysia. Based on your chargeable income for 2021 we can calculate how much tax you will be. This means that low-income earners are imposed with a lower tax rate compared.

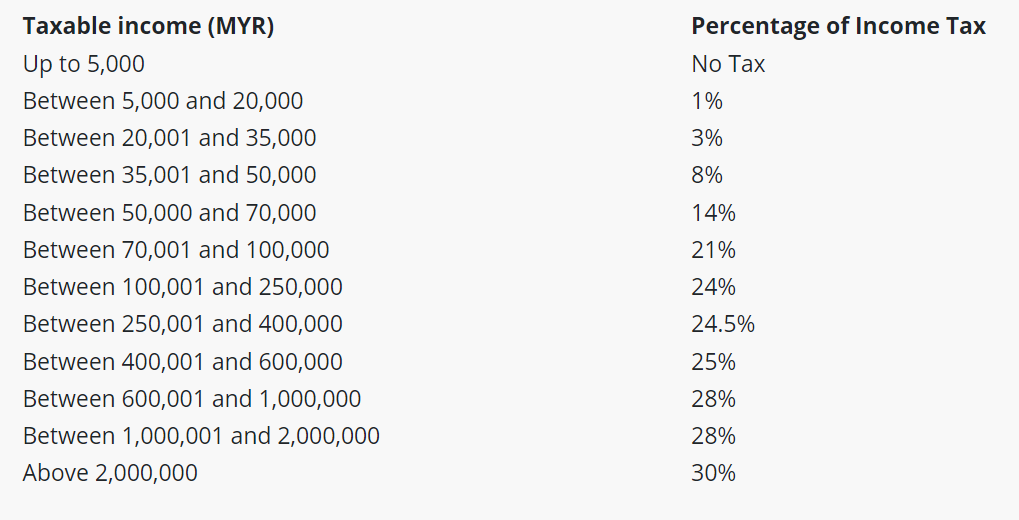

Tax Rates in Malaysia in 2022. Taxable income band MYR. Company having gross business income from one or more sources for the relevant year of assessment of not more than RM50 million.

Restriction On Deductibility of Interest Section 140C Income Tax Act 1967. Income Tax Filing Process Malaysia. The standard corporate income tax rate in Malaysia is 24 for both resident and non-resident companies which gain income within Malaysia.

Review the latest income tax rates thresholds and personal allowances in Malaysia which are used to calculate salary after tax. On first RM600000 chargeable income 17. Malaysia Income Tax Rates and Personal Allowances.

Petroleum income tax is imposed at the rate of 38 on income from petroleum operations in Malaysia. Malaysia has a territorial tax. Up to RM4000 for those who contribute to the Employees Provident Fund EPF including freelance and part time workers.

The personal income tax rate in Malaysia is. Malaysia adopts a progressive income tax rate system. On the First 5000 Next 5000.

By now you must have a good knowledge about tax rate. Starting from 0 the tax rate in Malaysia goes up to 30 for the highest income band. Malaysia Personal Income Tax Calculator for YA 2020.

However there are exceptions for certain. RM9000 for individuals. Tax RM A qualified person defined who is a knowledge worker residing in Iskandar Malaysia is taxed at the rate of 15 on income from an employment with a designated company engaged.

Calculations RM Rate TaxRM 0-2500. Taxable income band MYR. Malaysia has a progressive personal income tax system with a top rate of 30 and a tax rate that rises with an individuals income starting at.

Additionally the tax rate on those earning more than RM2 million per year has been increased from 28 to 30. Based on this amount your tax rate is 8 and the total income tax that you must pay. Tax reliefs and rebates There are 21 tax reliefs available for individual.

On the First 2500. To put this into context if we take the median salary of just over 2000 MYR per month⁴ a resident would pay. However the blended tax rate is much lower for most residents.

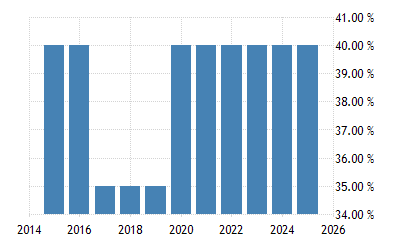

What is the income tax rate in Malaysia. Non-residing individuals are subjected to pay tax at a flat rate of 30 from 2020. Average Lending Rate Bank Negara Malaysia Schedule Section 140B.

An effective petroleum income tax rate of 25 applies on income from.

7 Tips To File Malaysian Income Tax For Beginners

Irs Announces 2022 Tax Rates Standard Deduction Amounts And More

一起考cpa吧 Income Tax Singapore Vs Malaysia Just Realize Facebook

Malaysia Budget 2021 Personal Income Tax Goodies

Overview Of Tax System In Malaysia Gelifesavers

Malaysia Personal Income Tax Guide 2022 Ya 2021

Personal Income Tax Asean Asean Business News

How To Calculate Foreigner S Income Tax In China China Admissions

Tax Rm Malaysia Personal Income Tax Rate 2020 Chegg Com

Individual Income Tax In Malaysia For Expatriates

Snapshot Of Asean Tax Rates Htj Tax

Chile Personal Income Tax Rate 2022 Data 2023 Forecast 2003 2021 Historical

Pdf Asean Tax Malaysia Asd Dsa Academia Edu

What Is The Difference Between The Statutory And Effective Tax Rate